Welcome to the Byron Property Search Market Watch. Twice a year, I attempt to read the pulse of the local property market, so this time has rolled around again. It is always the most clicked-through article in the newsletter, so I’m happy to continue it. Most property reports focus on national statistics, whereas the Australian property market is a patchwork quilt of diverse regional trends.

What’s The Buzz?

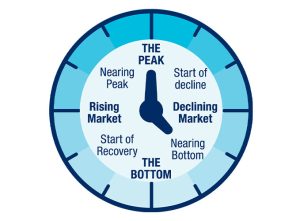

We are now at an interesting moment in the property cycle. The question many are asking is, are we at 7PM on the clock – Start of Recovery and past the Bottom? Are we about to see a market bounce? Interest rates are on the way down. The federal election is done and dusted. People have been distracted by many things for a while, and are we back to normal?

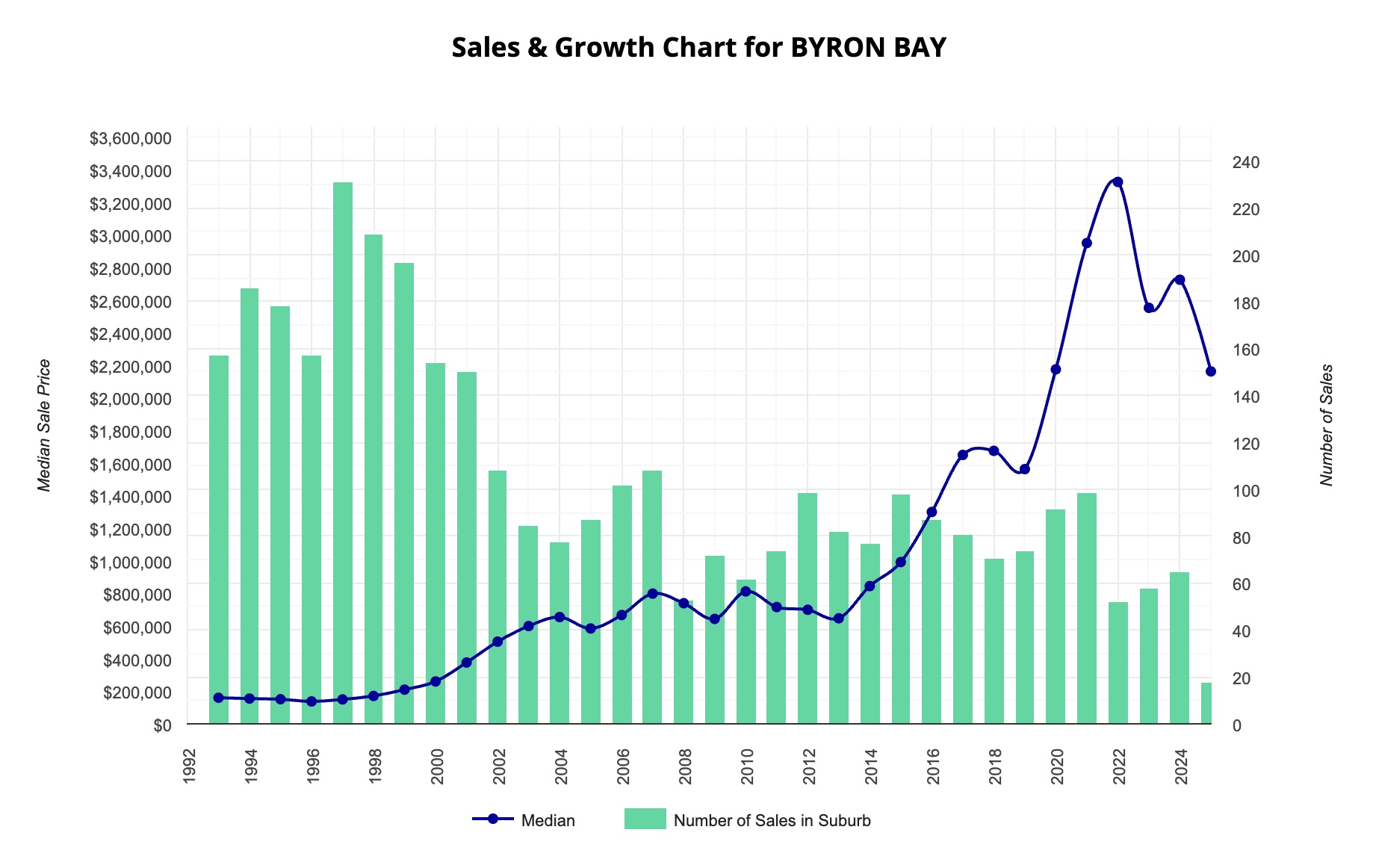

We need to take a step back and review recent activity. There was a massive jump in prices during the COVID lockdowns, as many people sought to escape cities and work from home. This saw an increase in the median house price in many coastal towns along the east coast. Some areas, such as Byron Shire, experienced increases of 50-60% during the COVID-19 pandemic. However, since then, we have seen a pullback from those highs of around 20-30%.

This article from The Sydney Morning Herald clearly outlines the issue. The headline reads The NSW sea-change towns where house prices plunged 20%. If we examine the attached graph, we can easily see the trend line. The Byron Bay (2481) median price went to $3.3 million in 2022 and is now back at $2.1 million. Many recent sellers failed to read the memo on this and have been trying to list at the top of the market, to their detriment.

Days on Market

The amount of time a property is listed for is a good indication of a market’s strength. The average Days On Market (DOM) is 32 days. Lennox Head currently has 60 days on market, and Byron Bay has 52 days. Lennox Head has a -3.91% discount to the original listing price, while Byron Bay’s is -1.59%. This suggests that most sales involve negotiation with buyers seeking value. Ocean Shores is similar with 50.1 days on market and a -2.16% discount. These statistics indicate a combination of buyer caution and excessive vendor expectations.

This means it is a softer market for Byron Shire than normal. Well-priced properties in good locations are selling, but there is no FOMO (Fear Of Missing Out). Buyers have no urgency as they know there is enough stock and they are not about to be gazumped. Over the past 25 years as a Buyer’s Agent in Byron Bay, our market has been mainly intense and heated. Therefore, the last two years have been similar to a normal market in most regions, characterised as active but not overly hot. As we head into this winter, sales demand is not yet outstripping supply, so we are not seeing any price rises. How long will that last is an interesting question.

Different Ranges

There are three distinct markets in Byron Shire and the Northern Rivers. Entry-level is anything below $1.2 million, mid-level is $1.2 million to $3 million, and top-end is anything above $3 million.

- Entry-level remains firm due to the housing crisis and a fundamental lack of affordable housing or reasonable rentals. The Bank of Mum and Dad is being stretched to get people into some kind of housing.

- Mid-level is the main bracket that is suffering. There is no investor market; there is no push to buy, except for the regular four D’s: Death, Divorce, Debt or Downsizing. Downsizing is challenging, as our high prices and limited availability of suitable apartments make it less attractive, and many empty nesters are opting to stay put.

- The top end is active but not overheating. We are still seeing wealthy high-net-worth individuals (HNWIs) move to the area and stake a claim to blue-chip properties. The slight change is that big rural acreages are no longer at the top of the wishlist. The younger affluent buyer is more interested in being closer to the beach and not having to drive kids around.

Gold Coast Push

Recently, I have been working on the Tweed Coast. Since the market is strong there, we are seeing demand shift from the robust Gold Coast market. The Goldie has transitioned from being a high-rise cultural catastrophe to a more livable city. This growth and demand are also affecting the Tweed Shire hinterland, as well as areas such as Casuarina, Cabarita, and Pottsville, which are experiencing stronger demand as buyers shift their attention south.

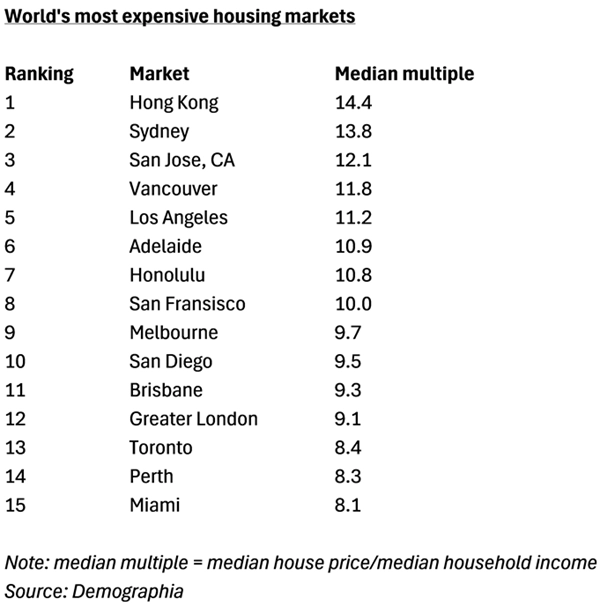

Most Expensive

National market trends are also of interest. Sydney is expected to surpass Hong Kong this year with the world’s most expensive real estate. Our five capital cities are among the top fourteen most unaffordable housing cities in the world, according to the new Demographia International Housing Affordability report. Sydney’s median house price is just shy of $1.5 million, while the Byron Bay 2481 median house price is twice that.

Community Sentiment

Currently, we are seeing an increasing debate around property supply and development. The housing crisis and lack of housing variety and options are now negatively affecting livability and productivity. Places like ours, with high residential property prices, are understandably nervous about pressure to allow more development and density. The green, leafy suburbs and beachside ambience, populated by NIMBYs, are now being challenged by the YIMBY movement to remove the white wicker fences and allow for more density.

Byron Shire will need to have this conversation at some point. Do we want to remain a refuge and exclusive enclave for the well-off and privileged? Or do we want to open ourselves up to diversity and accessible housing options? Our three-story limit is here to stay, and no one expects us to adopt high-rise living. Equally, no one wants wholesale urban sprawl that diminishes the rural aspect. Denser villages and master-planned communities, with walkability and active transport solutions, are the best alternative, as available in Europe. But are we ready to make the switch?

Recent Comments