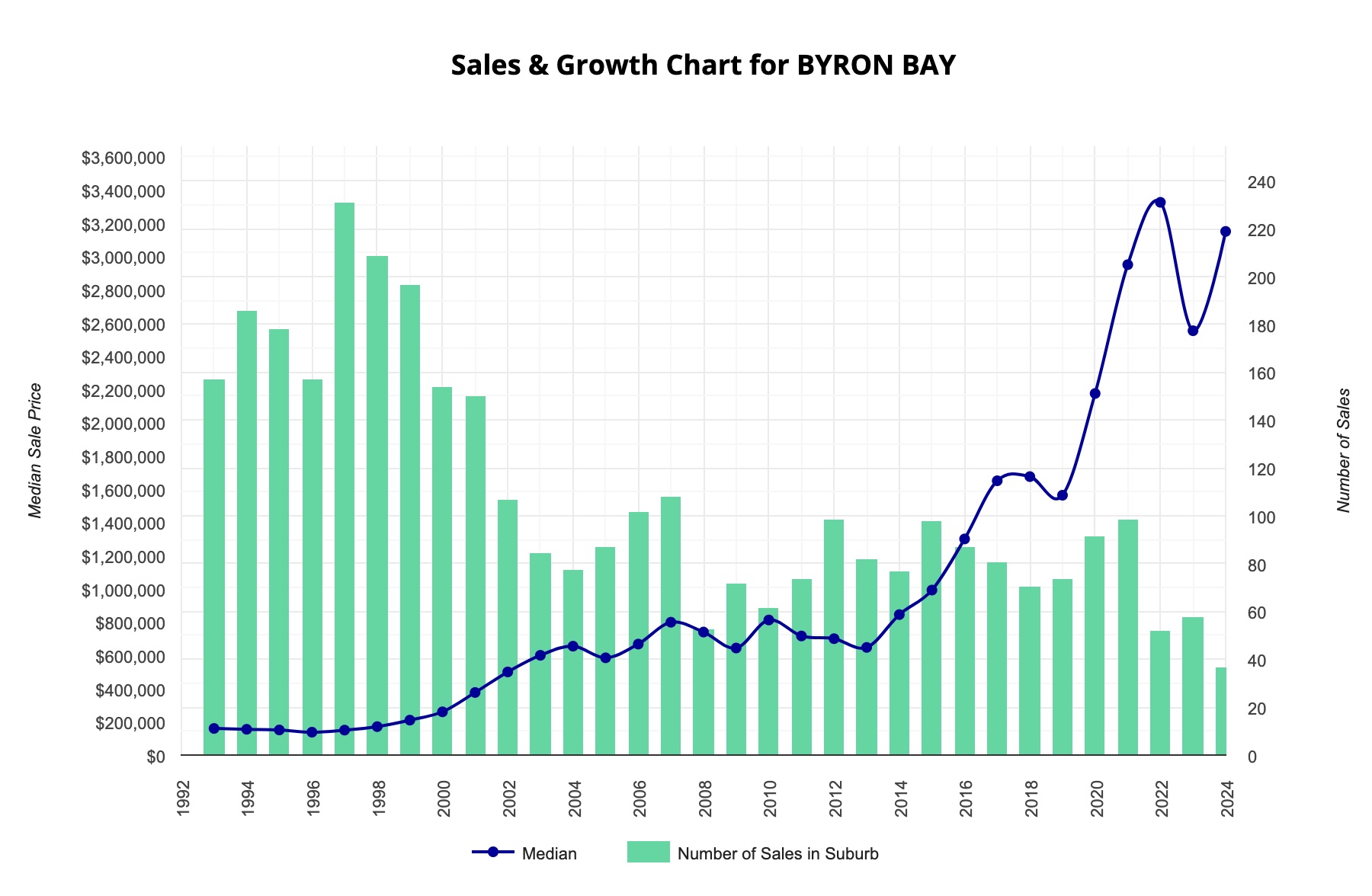

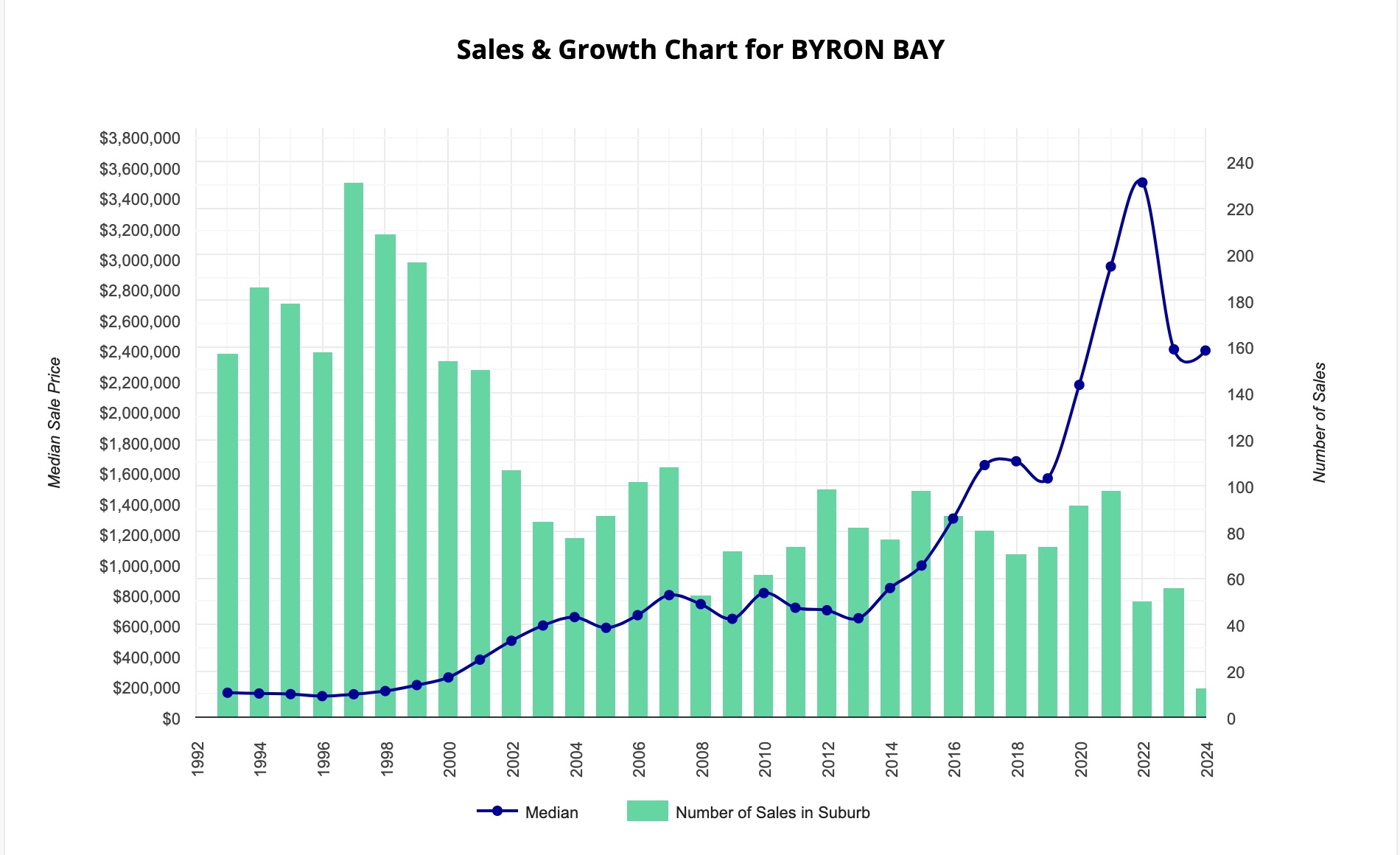

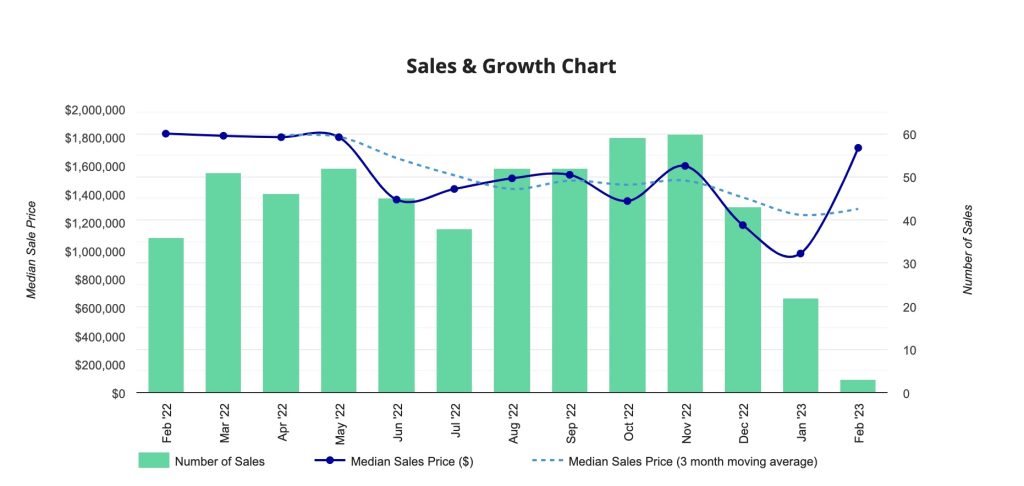

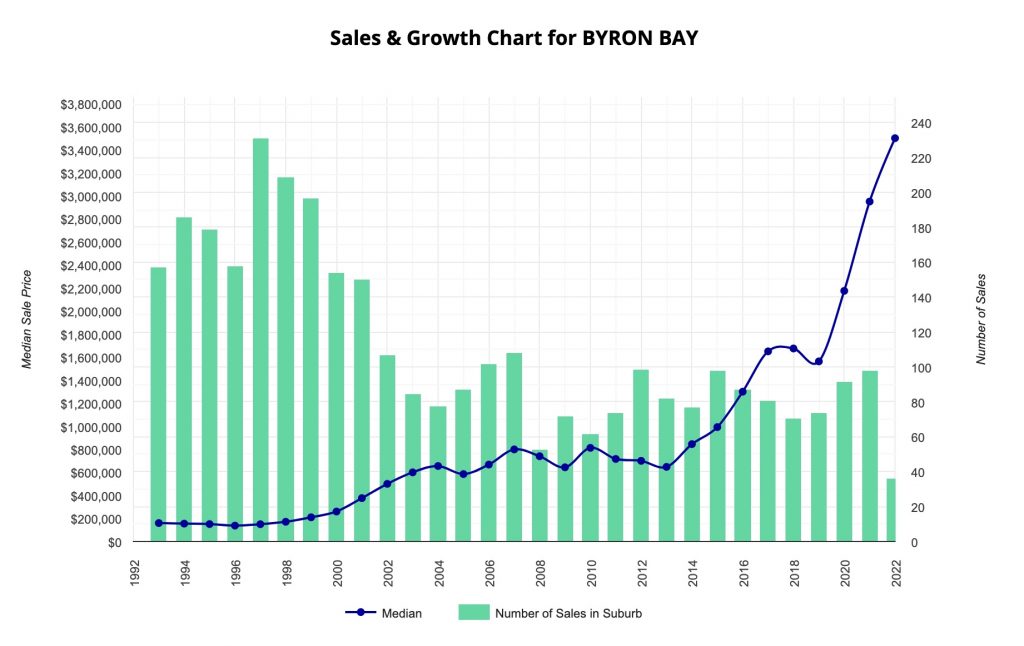

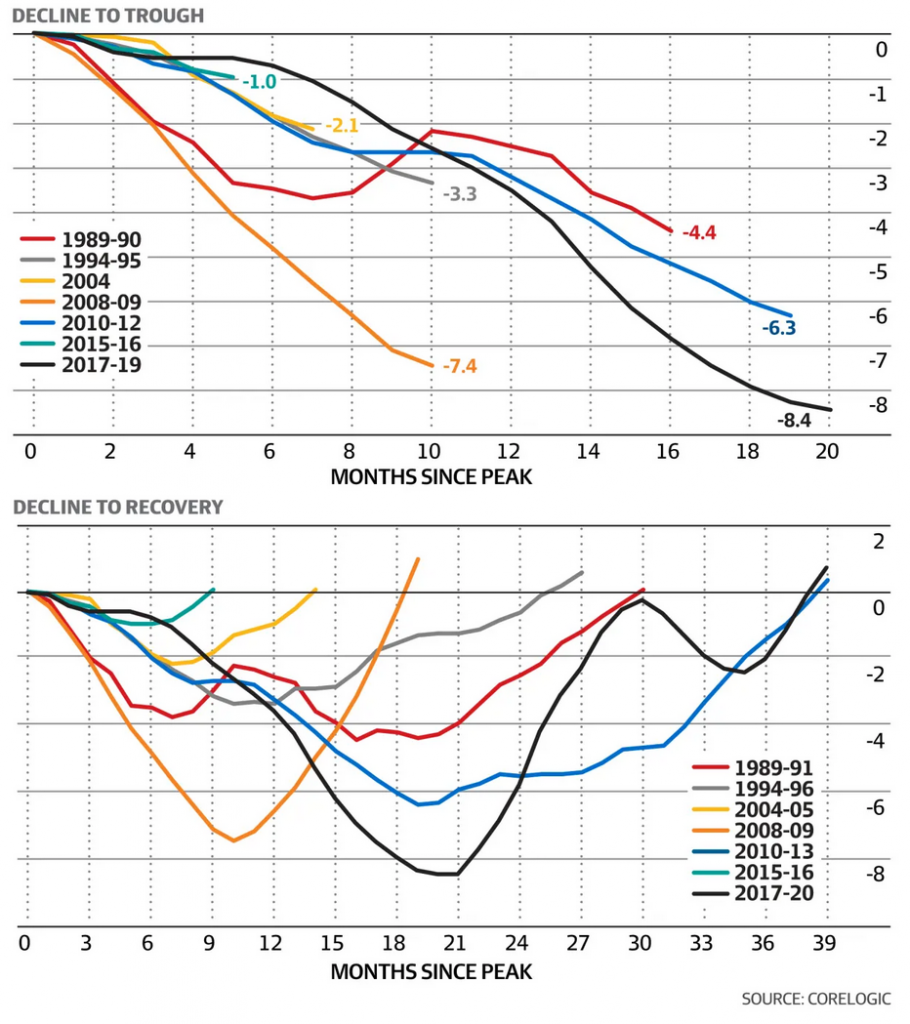

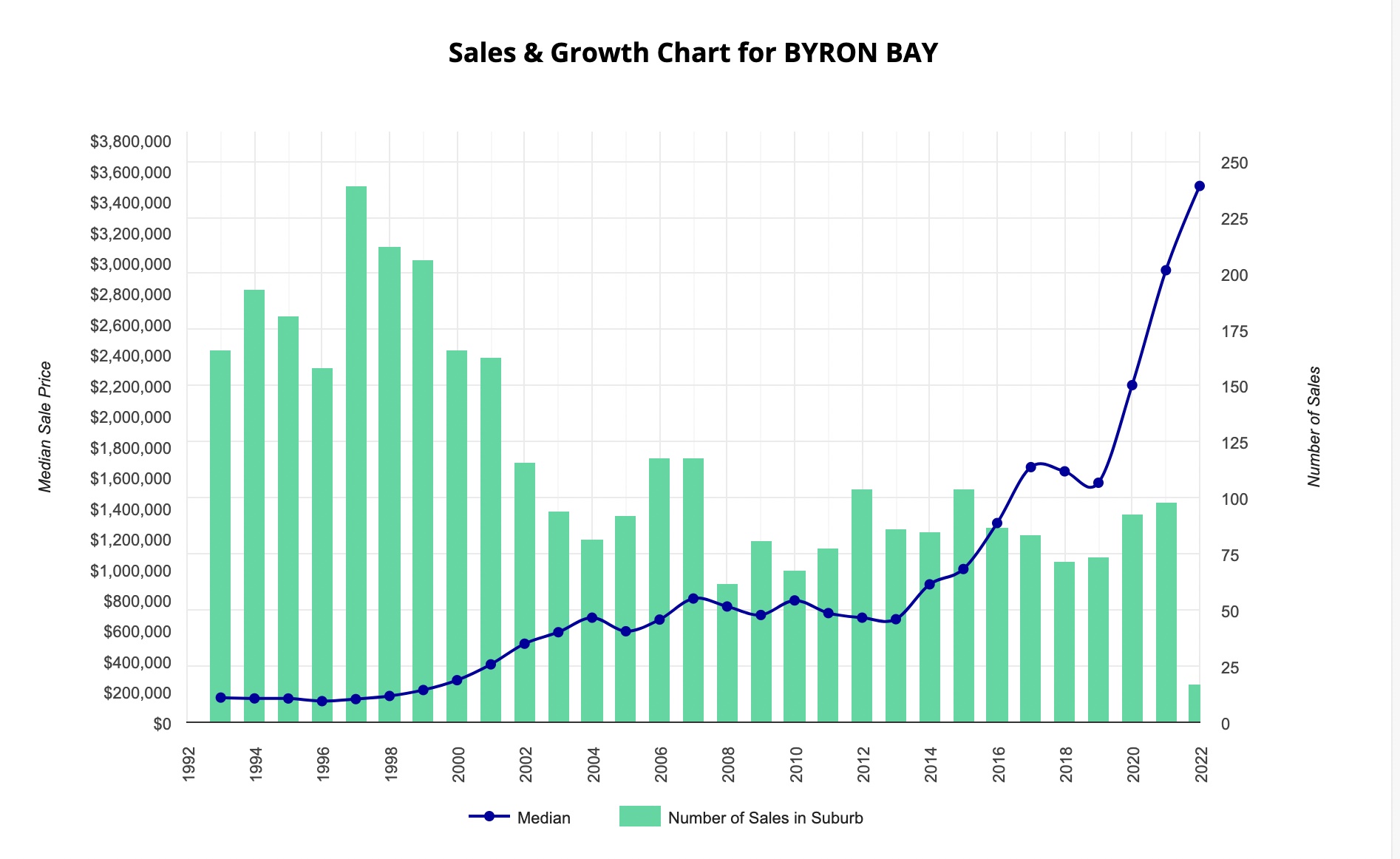

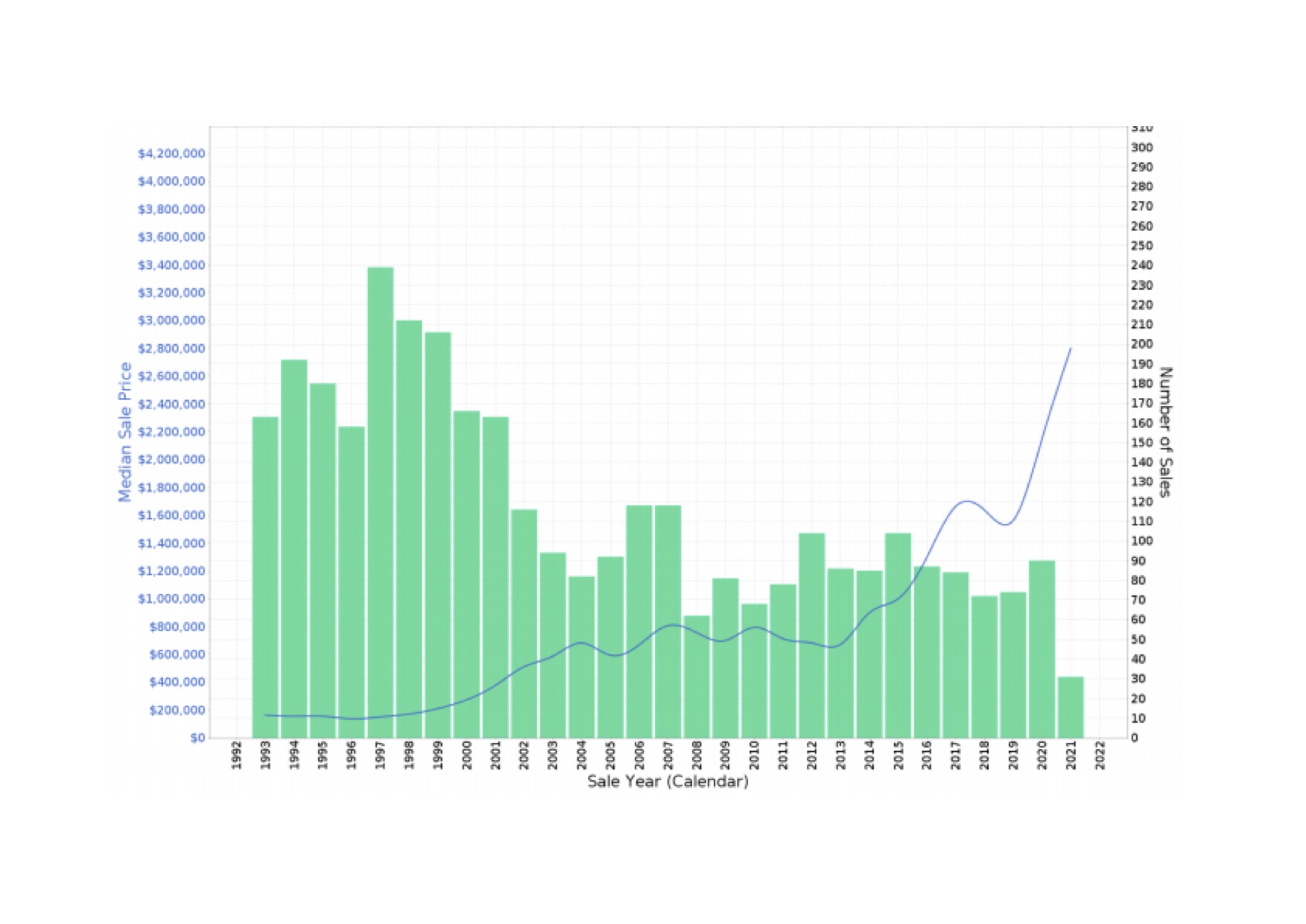

The property market in Byron Shire is finding some equilibrium after nearly four years of extremes and uncertainty. Prices suddenly dropped nationally as COVID-19 hit. Then, there was the rush from the cities, and many hinterland homes experienced extraordinary capital gains, which drove house prices to new highs and a 50-60% increase in the median house price.

After the sugar rush, we had indigestion and constriction. These prices were not maintained, and we had a pullback of around 30%. The median house price hit a mid-pandemic high of $3.5 million and then hit a low of $2.4 million. However, high-end properties suiting affluent buyers remain relatively stable compared to mid-market homes.

Trends and Challenges

Macroeconomic forces played a part in the downturn, as did natural attrition after such massive gains. Inflation, high interest rates, international wars and tensions, and cost of living concerns were all factors in our region’s general malaise. The Byron bubble did not burst but indeed lost some lustre. Demand and residential prices were down, as were commercial property and business turnover. It was unusual to see so many shopfronts for lease in the CBD of Byron Bay. Other factors were at play as well:

• FLOODING

Almost three years after the significant flood of February 2022, most of the literal and metaphorical mud has settled. Homeowners personally affected have had a triple whammy: distress around homelessness and loss of amenities, loss of property value, and a disastrous roll-out of government assistance—a classic case of overpromise and underdeliver.

The loss of property value is now baked in in these affected regions—neighbourhoods in Mullumbimby. South Golden Beach, Burringbar, Lismore, Wardell, and some parts of Ballina have fallen around 30%, and that price disparity will not be recovered over time. Some opportunities may exist in these places, which I elaborate on here.

• HOLIDAY LETTING CAP

The current downturn in Holiday Letting and Airbnb numbers happened before the recent 60-day per annum cap was introduced. It may be too early to tell, but there seems to be no sudden rush of HL homeowners selling or transferring to permanent letting. As was surveyed before the introduction of the cap, very few HL property owners intended to switch their properties to rental. There was substantial community support for this legislation, the only shire in the country to be granted this exemption, and many other LGAs are watching if it works. If nothing else, it will now limit the growth of Holiday Let properties, which is a good thing.

• HOUSING SHORTAGE AND RENTAL AFFORDABILITY

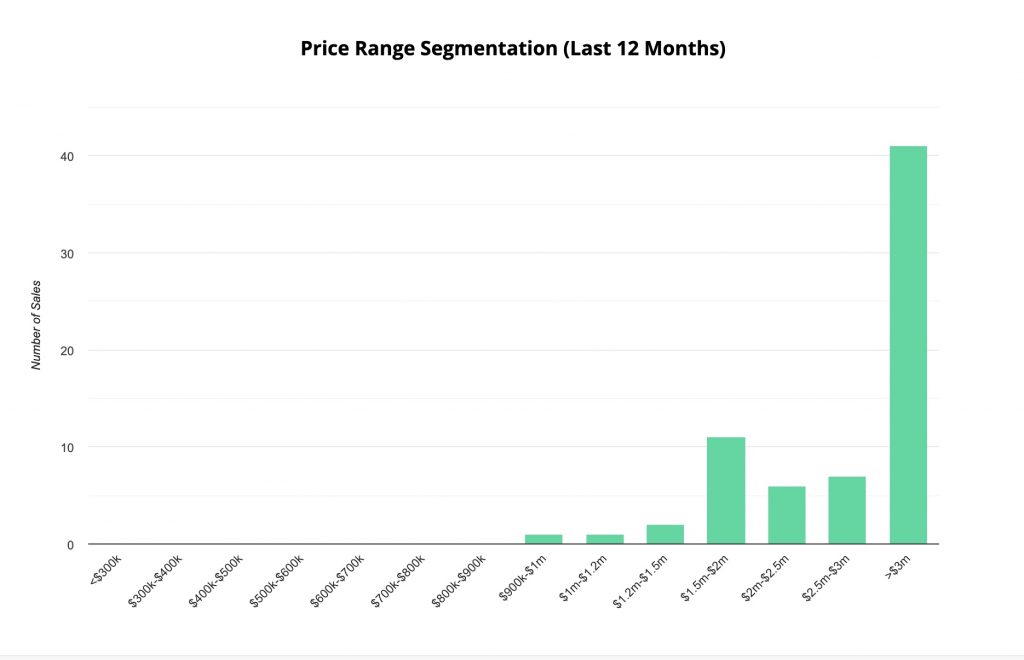

This is a most pressing issue with no visible solution in sight. The rollout of new housing, especially much-needed density dwellings for Key Workers, is cursory at best. The entry-level market, under $1.5 million, will remain strong as people struggle to find secure housing. Most are relying on the resources of the bank-of-mum-and-dad, currently Australia’s 9th highest lender and providing finance to 40% of first-home buyers.

Backpackers and casual workers are the mainstays of Byron Bay’s service economy. Many young people from South America come here to work and save enough money to travel further. They are resilient and can pack and share homes to make life affordable. They can also save money here, which is more difficult in their home country.

Conclusion

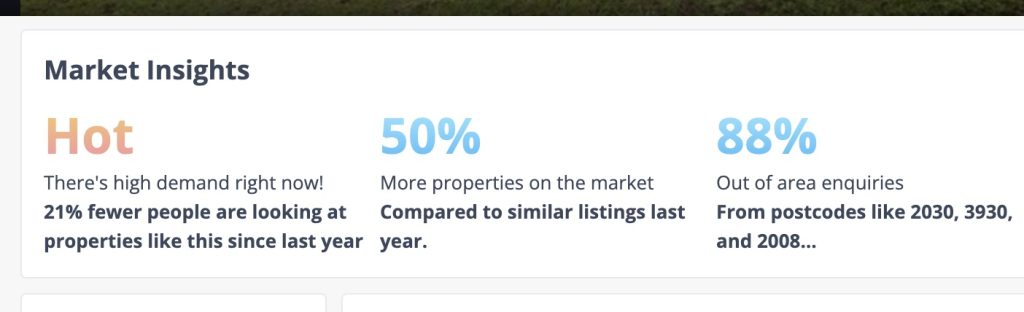

The old catchphrase that often sounds suspicious coming from a real estate agent – “It’s never been a better time to buy” – may be correct at this time. As interest rates and cost of living pressures ease, we will see more demand re-enter the market. Some agents are already having their best turnover for sometime.

Higher-than-usual stock levels are keeping prices in check for now. There are currently 485 listings, nearly 25% more than at this time last year. Many owners delayed listing, waiting for spring and a more robust market. Sellers are strongly advised to list at or below market rate to get offers, as discerning buyers are not prepared to overpay. But this may not be the case for long as the Byron bubble begins to regain its lustre.

Recent Comments