The roller coaster ride of the recent property market turbulence has not yet abated. Industry commentators are suggesting that we are past the major uncertainties, and we can expect to be back to normal sometime early next year.

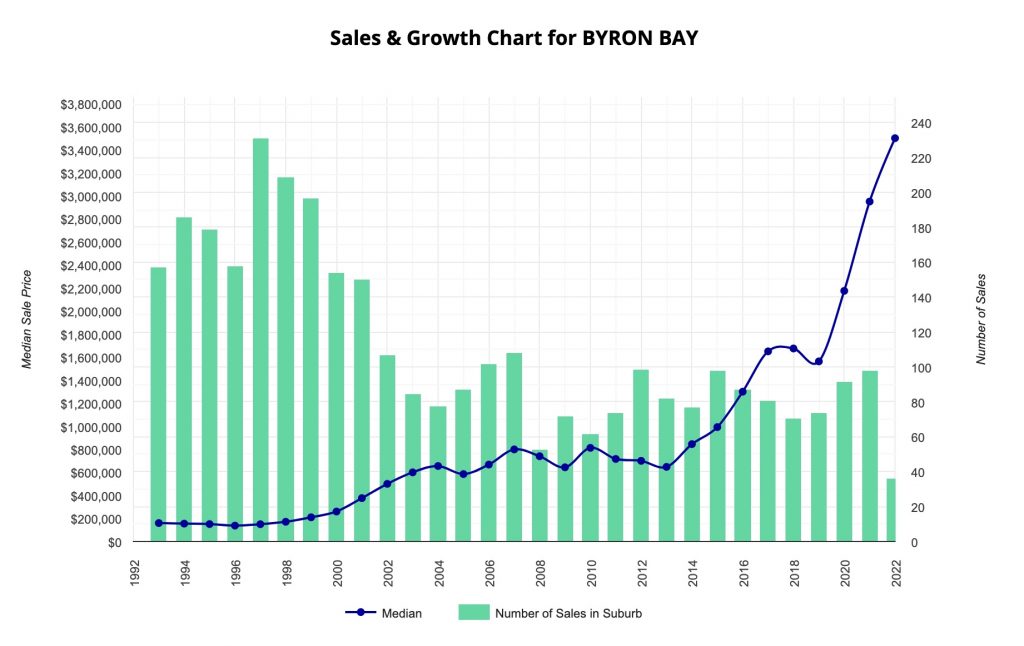

The downturn we needed to have has nearly exhausted itself and our local (Byron Shire) market will probably see a median house price reduction of no more than 5 – 15%. Some less in-demand areas, or floodplain properties, in the Northern Rivers, are liable for a bigger slide of closer to 20% or more. Byron Shire’s demand and housing shortfall should keep it buffered as there is no evidence of an abundance of forced or distressed sales.

As you can see in the accompanying chart from CoreLogic, the price reductions have not yet registered on the trend line due to the time lag. It is good to see that chart and recognise that this downturn is still minor in comparison to the rapid growth the market witnessed over the previous two years.

Patchy

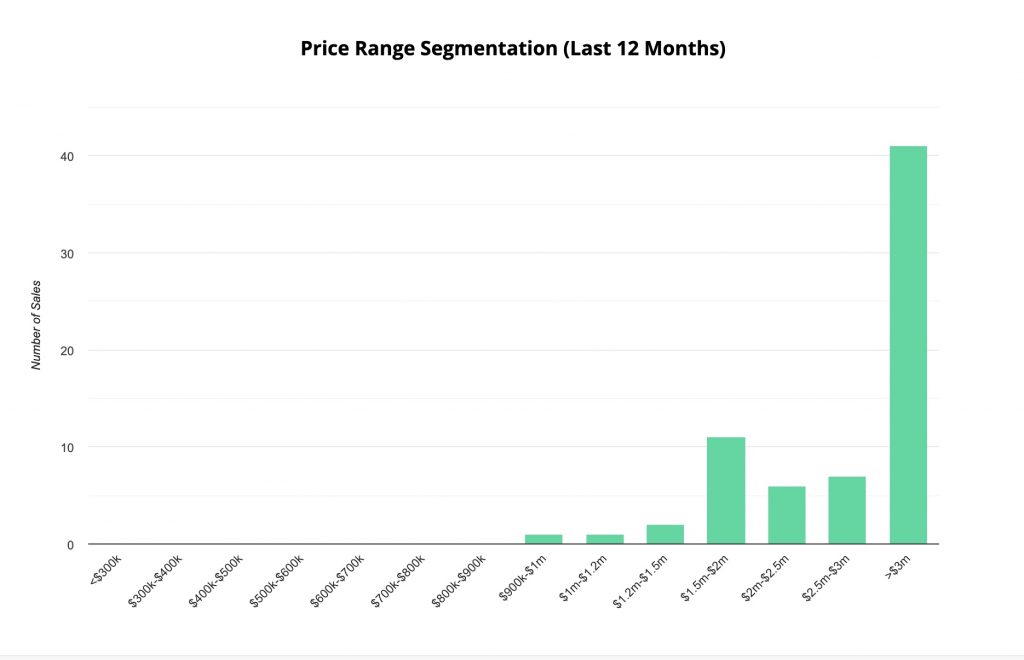

As usual, the median price decline has been patchy and not evenly spread to all property types and regions. Top-end rural with finished turnkey homes within 20 minutes from Byron are still finding buyers. However, the recent agitation caused by FOMO is no longer there and buyers can be more patient and discerning. Entry-level homes (under $1.2 mil) in good locations are also highly competitive as housing demand remains very high. The lack of available commercial and industrial space is also keeping prices buoyant in this category.

Prices are very soft in the mid-range suburban market: $1.5 – $2.5 mil range. Turnover in this bracket has dried up as most non-essential house buying has shrunk back to a minimum. Also showing very poor activity is anything that has been flood-damaged. The lack of appetite for homes that witnessed water inundation must be doubly disturbing to anyone wanting to sell after experiencing this traumatic event.

Market Watch 2022: National Trends

Of course, there has been lots of media chatter about the Australian property market. Most have been exaggerated or inaccurate because you cannot read local trends into nationwide data. Rising interest rates, international turbulence, energy prices, and other factors have been major detractors of consumer sentiment. The current pullback has been a natural reversal after such meteoric rises and anyone who expects property prices to head in only one direction is not cognisant of how markets work.

Price falls have occurred across the country – more in some places and less in others. Unfortunately, price falls have not improved housing affordability as rising interest rates have offset it. As national home prices have fallen, higher mortgage rates have canceled out increased affordability. Currently, it would take a typical Australian first home buyer 10.9 years to save for a deposit (assuming 30% of income is saved). This is barely lower than the 11.3 years required in the prior quarter, according to the ANZ CoreLogic Housing Affordability Report found.

Reasons to be cheerful

- Interest rates settle:

Most commenters think we are now close to the end of this spate of anti-inflationary interest rate rises. Again, like the recent price decline being minimal when taken in context, current interest rates are still below average over the long term. The current cash rate of 2.85% translates into an average home loan rate of between 5-6% while for a long time a 7% rate or higher was very normal. Either way, when interest rates settle it would seem likely that much of the delayed property movement will resurface. - Immigration numbers return:

As Covid 19 continues to fade, students, skilled workers, and the refugee intake resume demand for property will increase. According to PropTrack report, there is a surge in people from overseas looking for homes, The report states, “Approximately three-quarters of buy and rent searches come from the United Kingdom, the United States, and New Zealand.” - Flight to the regions not over:

A new report from buyers’ agency, Hotspotting indicates people will continue to move out of cities to regional areas. While the pandemic certainly exaggerated this existing trend, it had been building for five to six years already. Technology and work-from-home preferences enable people to work and have access to a better lifestyle. This is a long-term trend and it is not over yet. - Stamp Duty changes:

The new NSW Stamp Duty legislation ‘First Home Buyers Choice‘ may also help the market. The property reform was recently passed in the NSW parliament enabling first-home buyers in NSW the option to choose between paying an upfront lump sum stamp duty or an annual land tax, which will improve buyers borrowing capacities.

Conclusion on Market Watch December 2022

One of our prime ministers once said ‘this is a recession we had to have,’ he could equally say ‘this is the property downturn we had to have.’ Affordability and housing shortage are still major issues. People who purchased recently under the assumption provided by the RBA that interest rates will stay low for years have a reason to be annoyed. But although it can be stressful in the short term, try to hang on as something that looks like too much now may look like good buying in a few years’ time.

More Graphs:

This chart showing the list of coastal towns’ property values was of interest. Byron Bay is number one followed by Kiama, south of Sydney.

This chart is also very telling, showing what house price segmentation is in the last 12 months. As you can see, homes over $3 mil are dwarfing any other segment. But this is Byron Bay 2481, where most properties are over $2 mil. Mullumbimby’s main segment is $1.25 – $1.5 mil. Bangalow is $1.5-$2 mil.

Useful Links

Elephant in the Room podcast episode with Michael Murray