Winter Market Watch 2021 – May We Live in Interesting Times

The last year and a bit have been the most intense and unusual I have ever experienced. When the first signs of the seriousness of COVID kicked in in March/April 2020, there was a serious contraction and expectations of a downturn, even depression. This expected slump was not to be and instead we have had the largest and longest boom cycle most of us in the industry have ever experienced.

BOOM NOT SLUMP

It certainly did look like gloom and doom at the beginning of the pandemic. Being a tourism centred economy, many small businesses were under serious stress and concern. Many SMEs were under pressure trying to keep the doors open. Ironically, some were able to be nimble and adaptable and found revenue growth. Some people enjoyed the experience of slowing down and smelling the roses. Especially during those first couple of months as we had perfect weather, no traffic and good surf.

With real estate, I know of people who sold at this time expecting further losses. This proved to be the wrong move. Who could have then imagined we would move into one of the most sustained and exuberant periods of capital gain growth and intense demand?

We now Beat Sydney

Byron Shire now has the expensive property in the country – by a country mile. Only a few suburbs in the eastern suburbs and northern beaches of Sydney have higher property prices than Byron Shire. Byron Bay 2481 now has a median house price of $2.7 million while the Sydney average sits close to $1.4 mil. Internationally, Vancouver is the only other location that has higher property prices. Hong Kong was also a contender of this dubious honour until the recent Chinese political upheavals.

But there is a caveat for locals who are doing the math on this with their own home. This median is being skewed because of a large number of high end, luxury properties being sold in 2020/21. It is a mistake to expect every suburban home in the shire to experience a similar capital gain. There certainly is an increase, but not double.

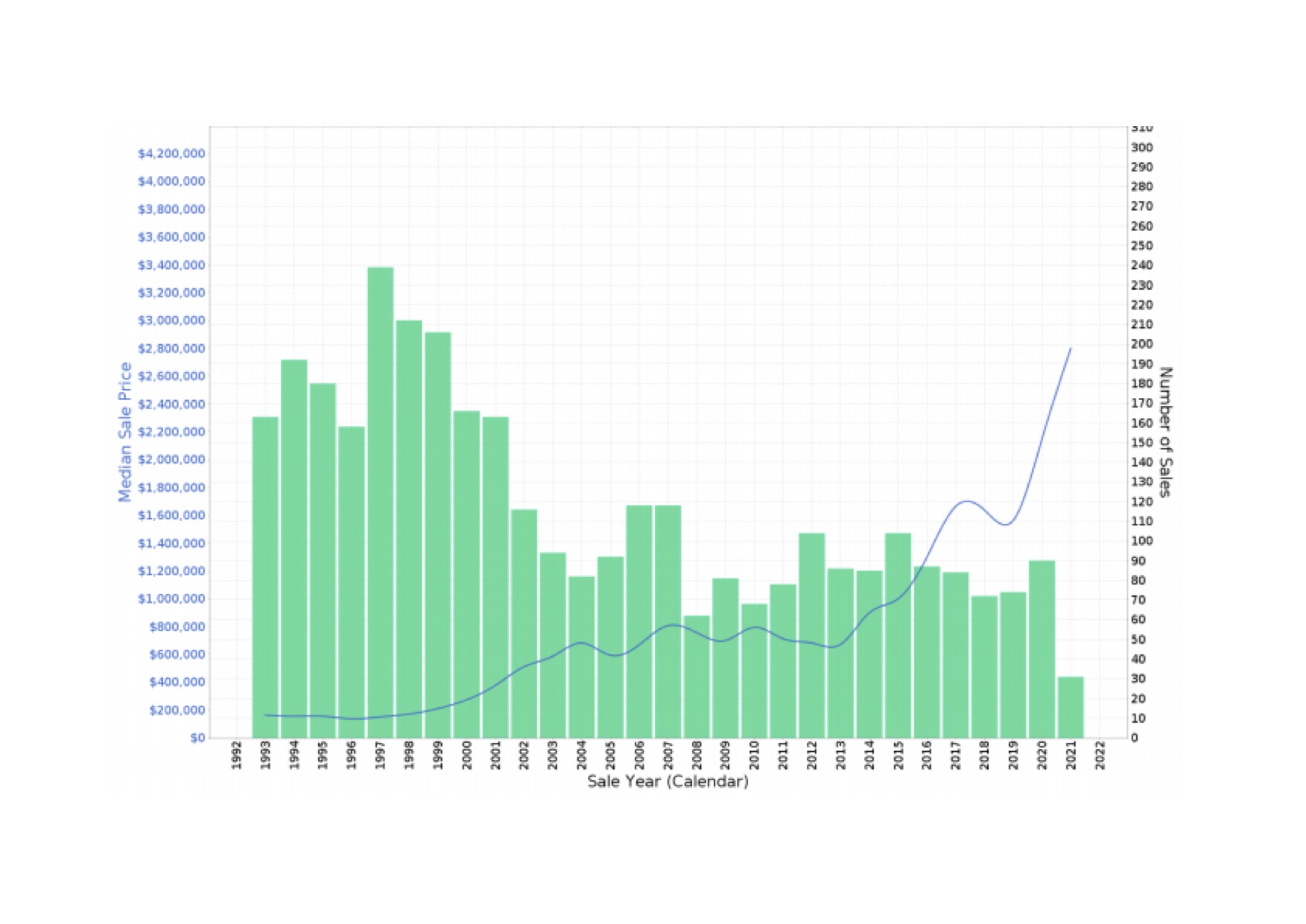

The attached graph shows you the median house price chart for Byron Bay. The local property market was already on a strong upswing during 2018/19. It then hit a slump in 2020 with COVID but then took off in an almost classic hockey stick chart. The median house price nearly doubled from around $1.4 mil to $2.7 mil. This is for Byron Bay 2481. Bangalow has had a median house price growth of 24% for the year, Mullumbimby 26.9%, Brunswick Heads 24.9% and Ocean Shores 17.3%.

Winners and Losers

With every major transition in a market like this, there are winners and losers. The situation with the rental market and affordable housing is dire. Rental vacancies were down to 0.03% when an average is supposed to be 3%. That means that for every 100 homes, 3 at any one time would be available for rent. That is how it should be but not the case now.

This is not just causing homelessness and social housing issues. Many long term residents are being forced out of the shire. Business owners, especially restaurants, are having problems keeping staff as there is no housing for workers and many are forced to commute long distances. Some business owners have resorted to trying to buy houses to secure accommodation for staff. Key workers like nurses, teachers and police are having difficulty finding housing. It has not been uncommon to hear about employed people or single parents being forced to sleep in their cars or vans.

Future Predictions

It is commonly accepted that this level of the price increase and demand is not sustainable. However, no one is commenting that we are in the midst of a bubble or imminent crash. Economists are predicting further price lifts before the end of the year.

A crash will only happen when there is an excess in the product due to overdevelopment, or excess in rental stock. There could be a turndown if the present record low-interest rates start the rise quickly but the RBA has signalled these rates will remain low till 2014 at least.

We are no longer seeing the intense demand for finished, top-end luxury homes (over $5 mil). It is still strong but we are not seeing the kind of uplift that has skewed the median house price data so strongly. We are still seeing massive demand for entry-level and suburban homes because of the scramble for people to secure a place to live. I have been to many auctions of homes under $2 mil and all have gone way over the advertised price range. I expect this to continue – at least for the remainder of the year.

Drill Down in the Data

- Westpac’s quarterly Housing Pulse report says this is officially a boom.

- most of the 90-odd sub-markets being tracked had recorded gains running at a double-digit annualised growth pace.

- Not one recorded a decline. “This is very rare in the history of Australian property cycles which more usually see a few markets ‘sit it out when prices are on the move”, the report said.

- HIA New Home Sales report shows that sales of new homes in NSW increased by 15.2 per cent in May 2021 compared to the previous month. This is 2.9 per cent higher than the same time in 2020.

- Sales are 36.9% higher than April and May last year.

- There is expected to be a record number of new home starts in 2021

- The attached article below is from Realestate.com.au with more info on the local market

Hot Properties - July / August / September 2022

43 Kingsley Street, Byron Bay

view more

Skyfall, 29 Browns Crescent, Mcloed's Shoot

view more

13 Edward Place, Knockrow

view more

Coorabell Ridge

view more

17 Whip Bird Place, Ewingsdale

view more

18 James View Court, Coorabell

view more

The Barbotine, 116-118 Jonson St, Byron Bay

view more

88-90 Mollys Grass Road, Tregeagle

view more

83 Mount Chincogan Drive, Mullumbimby

view more

59 Coopers Shoot Road, Coopers Shoot

view more

Amelika, 28 Blackbean Lane, Federal

view more