Market Watch – March 2023

I must do a Mea Culpa once more. The last Market Watch in November was predicting the market doldrums would be receding around now. Looks like the market will be remaining flat for quite a while longer.

In the July 2022 Market Watch, I posted graphs of previous downturns and how long it takes to rebound back. The average looks to be 24 months with the worst price fall and longest period of fall to rebound being 8.5% in 2017 – 2020. This current median price fall is already at 18% and we will probably be well past another 12 months before we gain that back.

Interest Rates

The RBA has been using rate rises as a blunt instrument to keep inflation under control. There are not many other levers and dials in monetary policy at their disposal. Either way, something is working as buyers all over the country are sitting on their hands, not raising them at auctions or working fingers over keyboards doing online property searches.

The RBA governor, Phillip Lowe, is in an unfortunate position and people seem to be taking it personally that he is the cause of rising rates and pinched budgets. The real estate market in this country moves as one and is dictated to by the mainstream media. They are either all gung-ho or doom and gloom. Never much nuance and the herd will move once the commentators say it’s all right again.

There remains a lot of uncertainty in the building and construction industry. Supply chain issues and rising material costs are major concerns for potential vacant land buyers. Builders and construction companies are feeling the squeeze and some are going under. For unexplained reasons, the construction industry does go quiet under a new Labor government.

It’s all in the Data

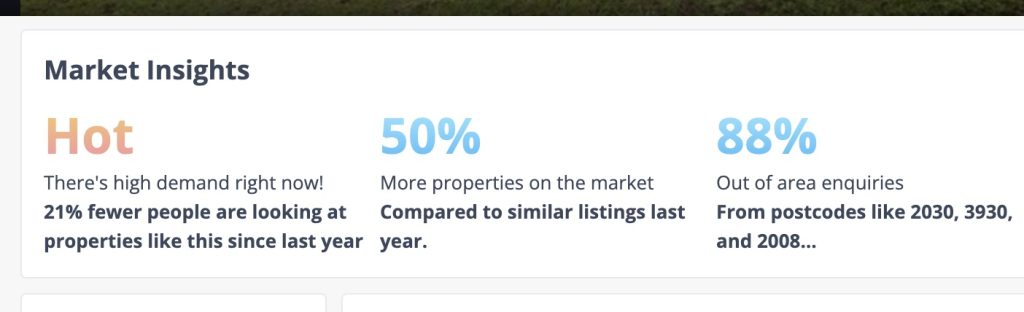

I posted this image on my FB feed recently and it created some interest. The data company I subscribe to still sees this area as a HOT market even though there are 21% fewer searches than this time last year. How HOT must our market have been at this time? There are also 50% more listings than this time last year, Ie a classic buyers’ market. 88% of all inquiries are from outside of the shire. Postcodes 2030, 3930, and 2008 are Vaucluse, Mount Eliza, and Chippendale, respectively.

According to property data firm CoreLogic, the Richmond-Tweed region is the worst-performing in the eastern states. House values have sunk 18.6% for the year to January, with sales volume down more than a third. Properties in the region also posted the longest time on the market, at 71 days, and the largest vendor discounts at 8.3%, in the three months to January. But this needs to be tempered by the 51% median house price increase during Covid. If we are close to the bottom now that means that the local median is still up 32.4% since 2020 which, put in context, is not too painful.

What’s Next?

People who do not need to sell into this market should stay on the sidelines and keep their powder dry. However, if you plan on selling and immediately buying in the same region, then there is not too much concern. Picking the right time, and the right listing price is crucial to getting a good outcome. Anyone who is planning on selling is welcome to contact me directly and I will explain my Vendor Advocacy service.

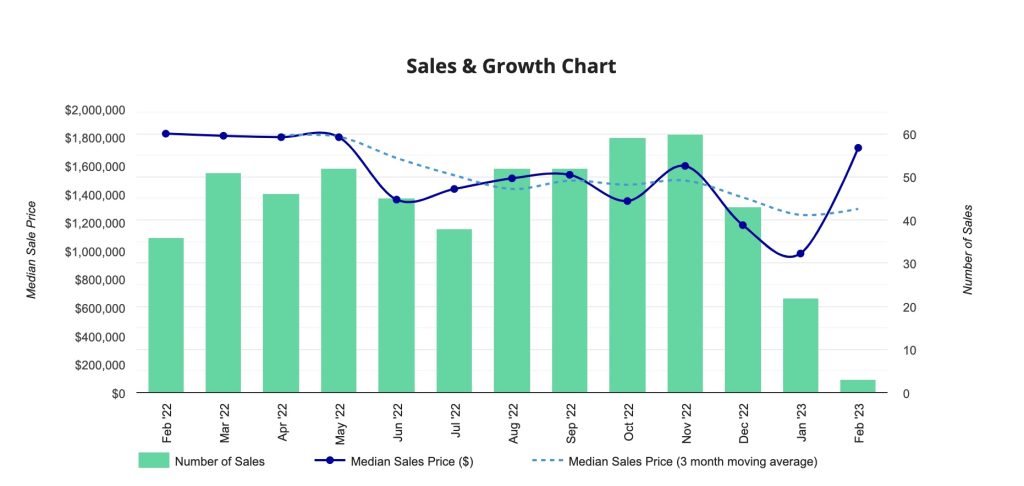

This graph is the growth chart for Byron Shire over the last 12 months. What is evident is the collapse of sales numbers. The uptick in prices is probably due to a combination of the time delay to go to settlement as well as a few recent top-end sales. Go to the Hot Property section to read about these new record-breaking sales. Top-end, as well as commercial units in the industrial estate properties, are still performing well.

Like any industry under pressure and tight times, we may see a reduction in the number of listing agents and buyer’s agents. Many got so use to putting up a sign and doing a deal the next day. They got spoilt by high prices and quick selling periods making them complacent – especially those who have not been through downturns.

Land Valuation

Ironically many property owners are now being slugged by unusually high land tax valuations. Yes, having to pay a lot of money to the Office of State Revenue is definitely a first-world problem. You only get a hefty increase in your assessment if your property values have increased. But this is an issue for many asset-rich/cash-poor property owners. Some may be forced to sell and cannot afford the bill. There is a time lag when you receive a Notice of Valuation from the Valuer General. In this situation now, people are getting their assessment at the bottom of a trough on valuations that happened at the tip of the high.

Swings and roundabouts! You can challenge your land tax assessment at this government site.

Hot Properties - July / August / September 2022

43 Kingsley Street, Byron Bay

view more

Skyfall, 29 Browns Crescent, Mcloed's Shoot

view more

13 Edward Place, Knockrow

view more

Coorabell Ridge

view more

17 Whip Bird Place, Ewingsdale

view more

18 James View Court, Coorabell

view more

The Barbotine, 116-118 Jonson St, Byron Bay

view more

88-90 Mollys Grass Road, Tregeagle

view more

83 Mount Chincogan Drive, Mullumbimby

view more

59 Coopers Shoot Road, Coopers Shoot

view more

Amelika, 28 Blackbean Lane, Federal

view more