Market Watch – July 22

Over my many years of watching the property market, it is amusing the observe the media reaction to a downturn. Doom, gloom and catastrophe make good headlines but often seem to be a ploy to sell papers or get more internet clicks. Exaggerating the booms and busts is standard behaviour for the mainstream media.

It is natural that we have a correction after such a strong growth period. Undoubtedly, there are many negative headwinds affecting the current market: rising interest rates, attention on the election, flooding and weather events, inflation pressures, and negative consumer sentiment. All these factors are at play and causing buyer interest and demand to severely wane.

Online inquiry rates are down close to 40% on May 22 compared with June 21. Even with this serious drop in buyer demand, properties are still selling as life and death go on. We will always have the four D’s – Death, Downsizing, Debt and Divorce – so real estate listings and sales will keep happening, just at a less buoyant rate.

Buyer’s Market

The mood has changed from FOMO – Fear of Missing, Out to FOOP – Fear of Over Paying. The switch from a seller’s market to one that benefits buyers is just that – it is now a good time to buy. Currently, I am not seeing any significant downturn in prices locally, but motivated vendors are certainly aware they will need to be realistic and competitive to sell in this market.

According to Corelogic, Regional Australia experienced a 0.5% price lift in May, but this was not enough to keep the national market in positive territory. Larger price falls were experienced in all the major cities except Brisbane and Adelaide. But in June, even these two cities experienced small drops. May was the first month since September 20 that the national housing price index went negative.

If you do not need to sell your existing home to buy, then this would be a good time to start the search and make offers. This is one of the few times in this highly desirous locale when vendors may be forced to settle for less than market value. As we are at the winter solstice, this saying is appropriate: ‘Buy sun hats in winter!’ If you are selling and buying in the same market, and intend to hold long term, then it does not really matter where on the trend line you do it. This article from Domain gives a second opinion on the ‘whether to buy now or later’ dilemma.

Picking the Bottom

To those that are thinking that the market still has further to fall and will wait for the bottom, good luck to you. If you have the foresight to know how to pick the market, then you obviously have access to higher powers and you don’t need to read this. My hunch, without any access to science or data, is that our market, not necessarily the national one, will have a small median house retreat (5%) and then show signs of strengthening again as early as later this year.

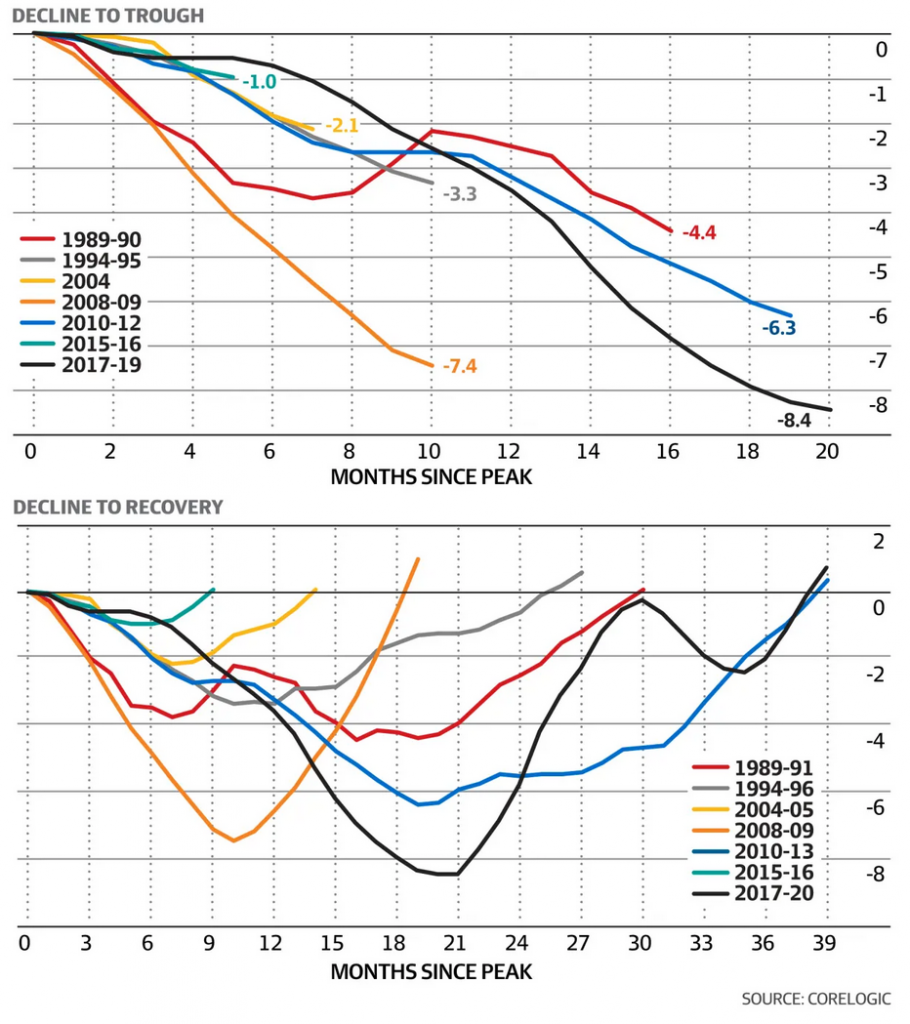

If wanting to pick the bottom is something that interests you, we only have historical data to go on. Below are two graphs that give the number of months from peak to trough and from peak to recovery. The number of months from top to trough is between 1 – 8.4. The number of months from peak to full recovery for all the property downturns going back to 1990, is 9 to 39 months.

Again, these graphs are for the national market and mainly deal with suburban tract homes and units. Byron Shire and other parts of the Northern Rivers will be dealing with a micro-market and not as affected by the negative headwinds listed above. Recent buyers here were not heavily mortgaged as most were cash transactions and therefore not panicked by rising interest rates. Our severe housing shortage will sustain demand for owner-occupiers and renters, and assuming this area remains a desirable place to visit and live, the downturn will be short-lived.

Other Problems

The main problem for incoming buyers here has usually been the highly competitive market. As a buyer’s agent over the last few years, I have been earning my fee mainly by getting my clients ahead of the other buyers. The current issue for incoming buyers is the need to be aware that we are also suffering from supply and labour shortages. It is very difficult to get trades or service providers. Building materials and some products are difficult to source and very expensive. Builders and renovators are averse to taking on fixed-cost quotes. Best to stay away from new builds or renovations in this present climate.

If you are thinking of listing, the main requirement is getting an accurate estimate. It would be difficult to value most rural and unique properties in this changeable market. Getting good advice will be crucial and could make the difference between a successful outcome and falling way short. If you do not already have a good relationship with an experienced agent, I would be happy to talk to you about my vendor’s advocacy service.

Short Term Holiday Letting limit

For those that have not been paying attention, BSC looks like they will successfully be able to introduce their long-sought-after 90-day STHL limit. This will allow a 365-day holiday letting in certain zones (Wategos, Belongil, Suffolk Beach, etc), but only a 90-day limit in all other areas. I have heard some chatter that this may cause a sell-off of HL properties and affect the market. I am not aware of any evidence of this and don’t think it will make a lot of difference to property prices. Unfortunately, I also predict that it will make very little difference as a housing crisis solution – but happy to be proved wrong with that. More opinion on that here from a previous blog.

Byron Bay 2481

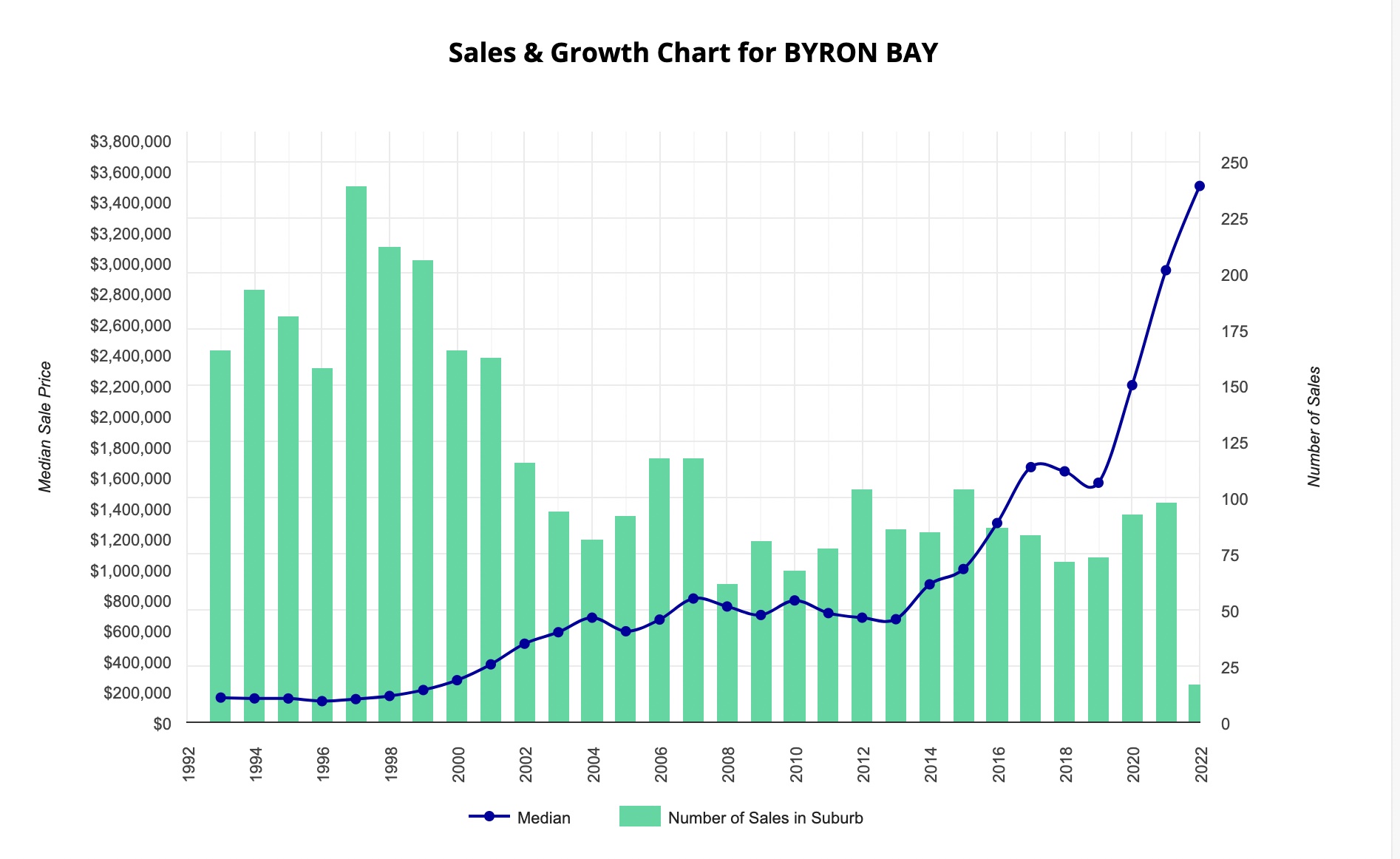

To provide some perspective on the recent housing trend line below is the CoreLogic chart for Byron Bay 2481. This is not indicative of the whole Byron Shire or wider Northern Rivers. It is also inflated because there have been quite a few top-end luxury properties for sale over the COVID period sold to pandemic refugees.

Conclusion

This commentary may seem overly upbeat. Yes, there are huge issues and concerns and I am certainly aware of the many factors that could bring on a general global asset crash. After clocking up more than a few decades of life experience I look back and think “When were we NOT on the edge of some major catastrophe?”. We always manage to muddle through – but there may come a time when we don’t.

Enjoy life in the meantime.

Hot Properties - July / August / September 2022

43 Kingsley Street, Byron Bay

view more

Skyfall, 29 Browns Crescent, Mcloed's Shoot

view more

13 Edward Place, Knockrow

view more

Coorabell Ridge

view more

17 Whip Bird Place, Ewingsdale

view more

18 James View Court, Coorabell

view more

The Barbotine, 116-118 Jonson St, Byron Bay

view more

88-90 Mollys Grass Road, Tregeagle

view more

83 Mount Chincogan Drive, Mullumbimby

view more

59 Coopers Shoot Road, Coopers Shoot

view more

Amelika, 28 Blackbean Lane, Federal

view more